BridgeBio Pharma Reports Fourth Quarter and Full Year 2022 Financial Results and Business Update

–Phase 3 ATTRibute-CM registrational trial of acoramidis for transthyretin amyloid cardiomyopathy (ATTR-CM) continues to have high operating fidelity; month 30 topline registrational data are expected to be announced in mid-2023

–Phase 2 PROPEL 2 trial of low-dose infigratinib as a potential treatment option for children with achondroplasia continues to progress with Cohort 5 data expected to be announced in March of 2023

–Initiated Phase 3 CALIBRATE registrational trial of encaleret in autosomal dominant hypocalcemia type 1 (ADH1), with topline data expected to be announced in late 2023 or the first half of 2024

–Continued progress towards 2023 initiation of a global Phase 3 registrational clinical trial of BBP-418 for limb-girdle muscular dystrophy type 2i (LGMD2I)

–Phase 1/2 trial of BBP-631 for treatment of congenital adrenal hyperplasia (CAH) continues to advance with a data update including patients at the third dose level planned by the end of 2023

–Ongoing development of three lead KRAS programs, with an Investigational New Drug (IND) application planned for next-generation KRASG12C dual inhibitor BBO-8520 in second half of 2023

–Ended quarter with $466.2 million in cash, cash equivalents, marketable securities, and restricted cash (current), providing runway into 2024

PALO ALTO, Calif., Feb. 23, 2023 (GLOBE NEWSWIRE) — BridgeBio Pharma, Inc. (Nasdaq: BBIO) (BridgeBio or the Company), a commercial-stage biopharmaceutical company focused on genetic diseases and cancers, today reported its financial results for the fourth quarter and full year ended December 31, 2022 and provided an update on the Company’s operations.

“We are excited to enter 2023 back on the doorstep of potentially meaningful advances for the patients we serve,” said Neil Kumar, Ph.D., founder and CEO of BridgeBio. “Amidst our six ongoing Phase 2 or 3 clinical trials, we anticipate important upcoming readouts from our achondroplasia Phase 2 trial in March, and our ATTR-CM Phase 3 trial mid-year.”

BridgeBio’s key programs:

-

Acoramidis (AG10) – Transthyretin (TTR) stabilizer for

transthyretin amyloid cardiomyopathy (ATTR-CM):

- The Phase 3 ATTRibute-CM study continues to have high operating fidelity.

- The Company expects to announce topline registrational data for the month 30 primary endpoint, a hierarchical composite including all-cause mortality and cardiovascular-related hospitalizations, in mid-2023.

-

Low-dose infigratinib – FGFR1-3 inhibitor for

achondroplasia and hypochondroplasia:

- In July 2022, we reported initial data from the fourth dosing cohort of the Phase 2 dose-escalation trial PROPEL 2, demonstrating a mean change from baseline in annualized height velocity (AHV) of +1.52 cm/year and a responder rate of 64% in children five years of age and older.

- Through the fifth dosing cohort to date, infigratinib has been well-tolerated with no serious adverse events reported, no adverse events that required discontinuation reported, and with no dose-dependent phosphate elevation reported.

- The Company expects to share preliminary data from the fifth dosing cohort in March 2023, and to initiate a registrational Phase 3 trial in 2023.

- In Cohort 5, the Company hopes to observe a tolerability profile and efficacy at least in-line with Cohort 4. If successful, the Company believes infigratinib, if approved, has the potential to capture a significant share of the market based on blinded market research.

-

Encaleret – Calcium-sensing receptor (CaSR) inhibitor for autosomal dominant hypocalcemia type 1

(ADH1):

- In December 2022, the Company initiated the CALIBRATE Phase 3 trial, a pivotal trial comparing the effects of encaleret to standard of care on blood calcium concentration and 24-hour urine calcium excretion over a 24-week treatment period in patients with ADH1.

- In a Phase 2b safety and efficacy trial of encaleret for ADH1, 69% of the participants achieved concurrent values of both blood calcium concentration and 24-hour urine calcium excretion within the reference range after 24 weeks of outpatient encaleret treatment; none of these individuals attained this dual therapeutic goal while on standard of care.

- Population genetics analyses estimate approximately 25,000 carriers of gain-of-function variants of the CaSR, the underlying cause of ADH1, in the US and EU.

- The Company anticipates sharing topline data from CALIBRATE in late 2023 or the first half of 2024.

- If approved, encaleret could be the first therapy specifically indicated for the treatment of ADH1.

-

BBP-418 – Glycosylation substrate for limb-girdle muscular

dystrophy type 2i (LGMD2I):

- The Company reported positive top line data from the ongoing Phase 2 clinical trial in October 2022 and anticipates initiating a global Phase 3 registrational trial of BBP-418 for LGMD2I in 2023.

- To that end, the Company has engaged with regulatory authorities to align on a Phase 3 trial design.

- BBP-418 has a potentially-addressable population of 7,000 LGMD2I patients in the US and EU.

- There are currently no disease-modifying treatments available for LGMD2I.

-

BBP-631 – AAV5 gene therapy candidate for congenital

adrenal hyperplasia (CAH):

- The Phase 1/2 gene therapy trial of BBP-631 for CAH continued to progress; as of February 1, 2023, BBP-631 has been generally well-tolerated in four patients treated at the first two dose levels.

- The Company plans to provide an update from patients treated at the third dose level by the end of 2023.

- CAH is one of the most prevalent genetic diseases potentially addressable with adeno-associated virus (AAV) gene therapy, with more than 75,000 cases estimated in the United States and European Union.

-

RAS cancer portfolio:

-

BridgeBio is continuing to progress the three main

programs of its RAS franchise:

- BBO-8520, an investigational, next-generation small molecule KRAS G12C dual inhibitor candidate that is designed to directly bind and inhibit KRAS G12C in both its active (GTP bound) and inactive (GDP bound) conformations, which remains on track to file an IND and enter the clinic in the second half of 2023.

- A PI3Kα:RAS breaker program, investigational small molecules that are designed to block Ras-driven PI3Kα activation with a novel and potentially broad mechanism of action to target not only PI3Kα mutant tumors and RAS mutant tumors, but potentially other tumors driven by RTK activation of RAS signaling. The Company remains on track to select a development candidate in 2023, with IND filing to follow in 2024.

- The Company’s pan-KRAS program, which targets multiple KRAS mutants including KRASG12D and KRASG12V, which are present in a large percentage of colorectal, pancreatic, and non-small cell lung cancer tumors. Development candidate selection for this program is planned for late 2023 or early 2024.

-

BridgeBio is continuing to progress the three main

programs of its RAS franchise:

Corporate Updates:

- Board of Directors: Appointed Frank McCormick, Ph.D., FS, DSc (Hon) to the BridgeBio Board of Directors. Dr. McCormick is a co-founder of BridgeBio and serves as the Chairman of Oncology. He is also a professor at the UCSF Helen Diller Family Comprehensive Cancer Center, where he holds the David A. Wood Chair of Tumor Biology and Cancer Research, and he has led the National Cancer Institute’s Ras Initiative since its inception in 2013. Dr. McCormick rotates in as Dr. Richard Scheller leaves the Board of Directors; Dr. Scheller will continue to serve as BridgeBio’s Chairman of Research and Development. In addition, Brent Saunders will resign from the board of directors in early March in order to focus on his recent appointment as Chief Executive Officer and Chairman of the Board of Bausch + Lomb.

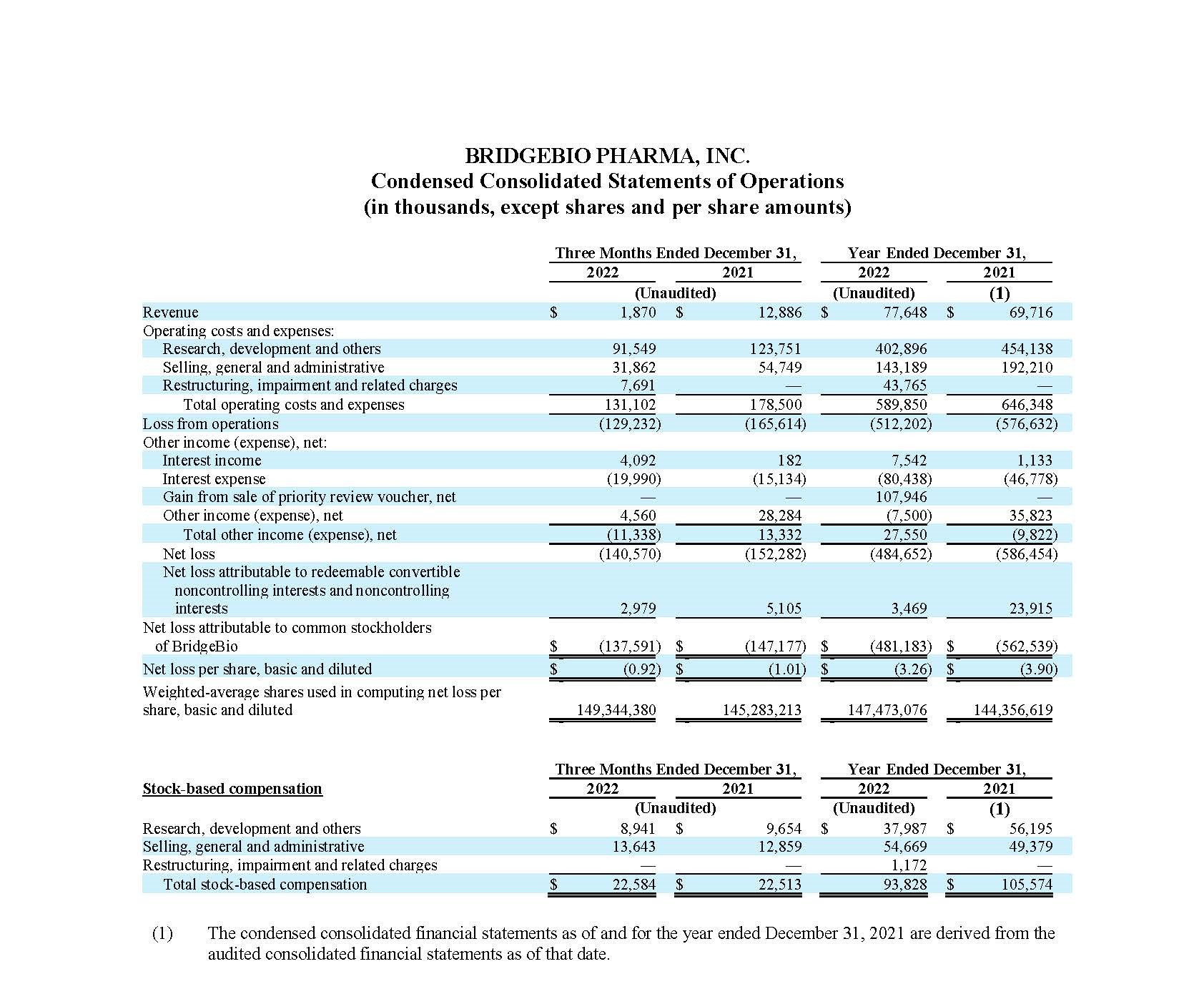

Fourth Quarter and Full Year 2022 Financial Results:

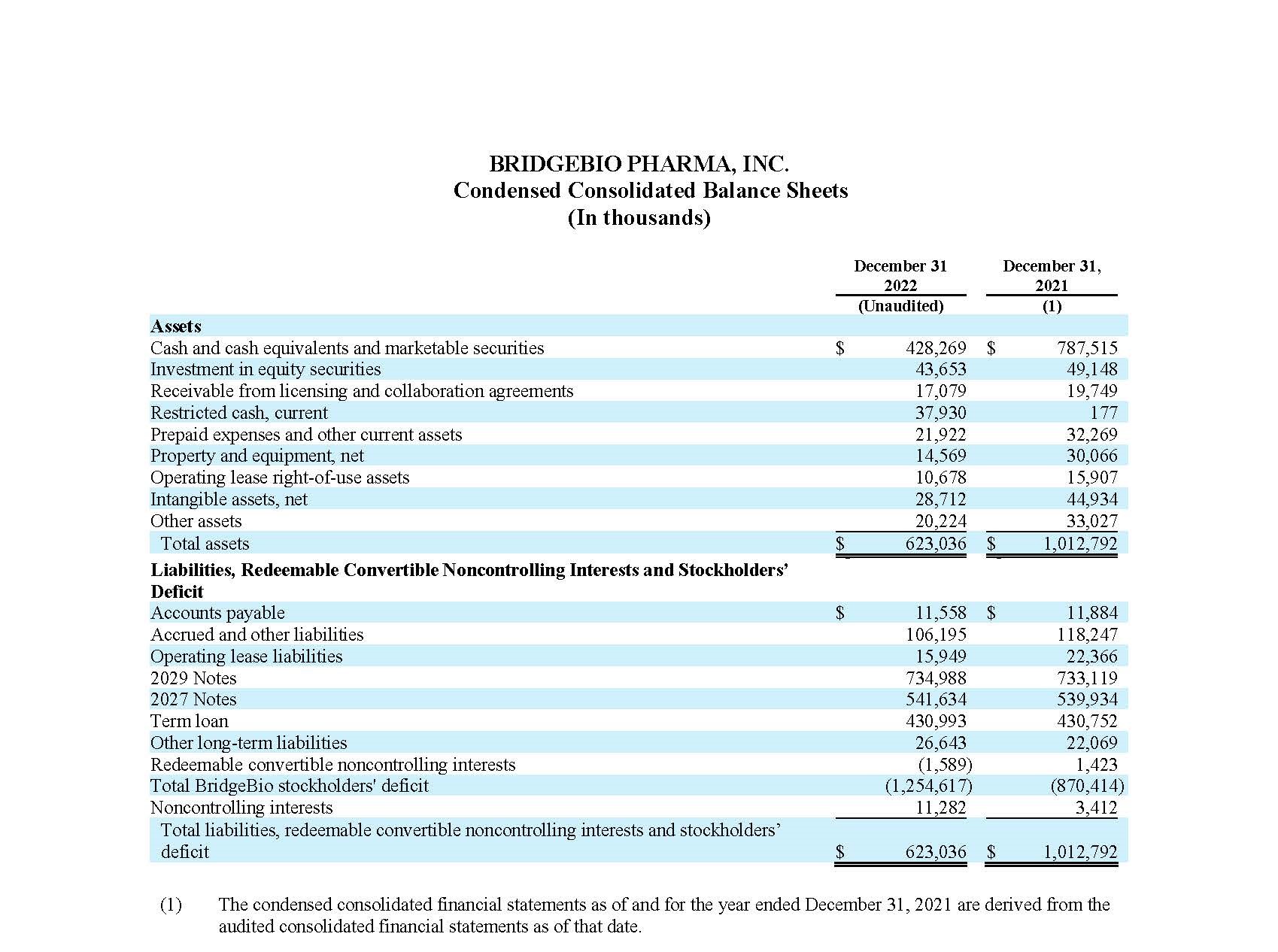

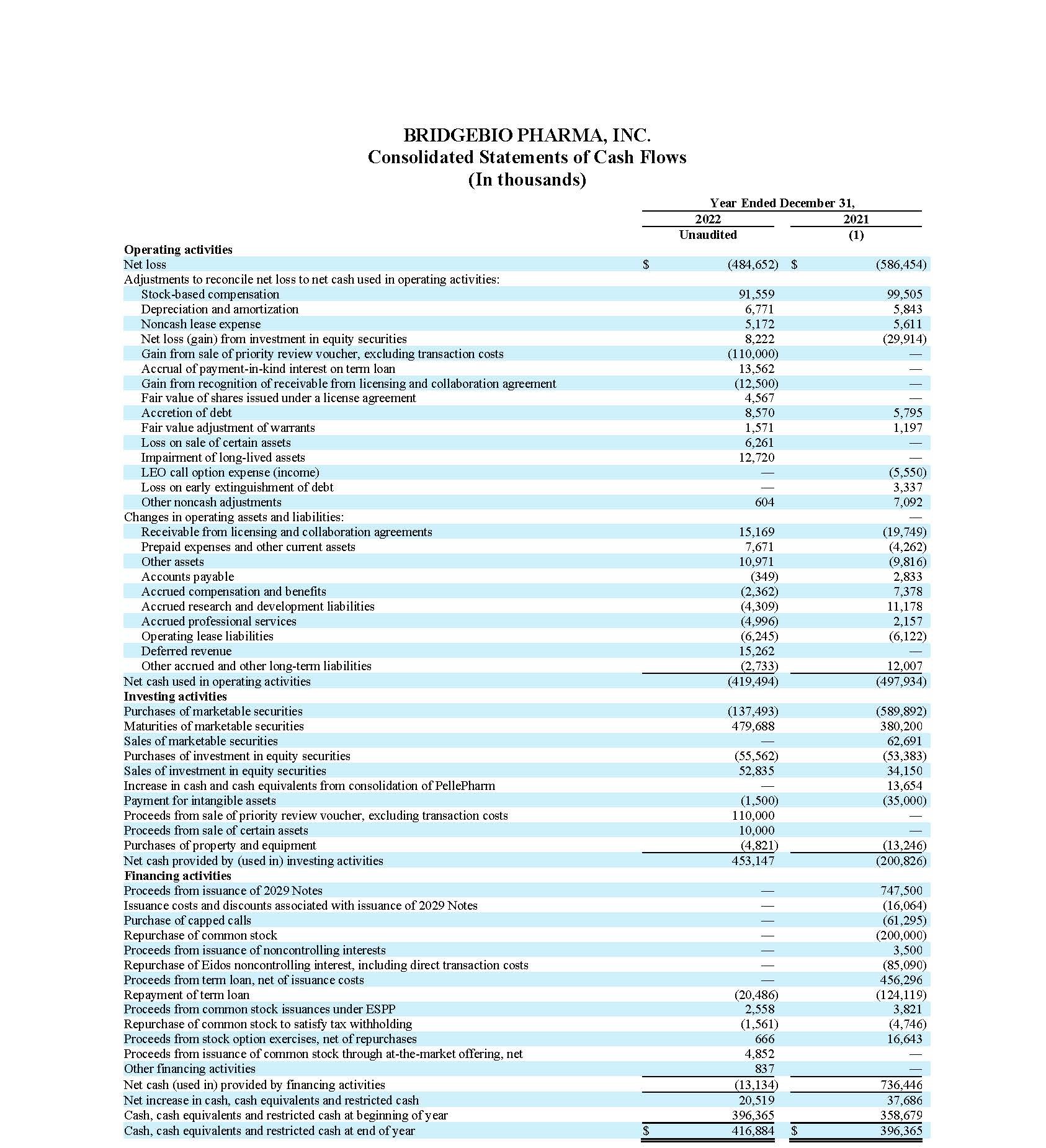

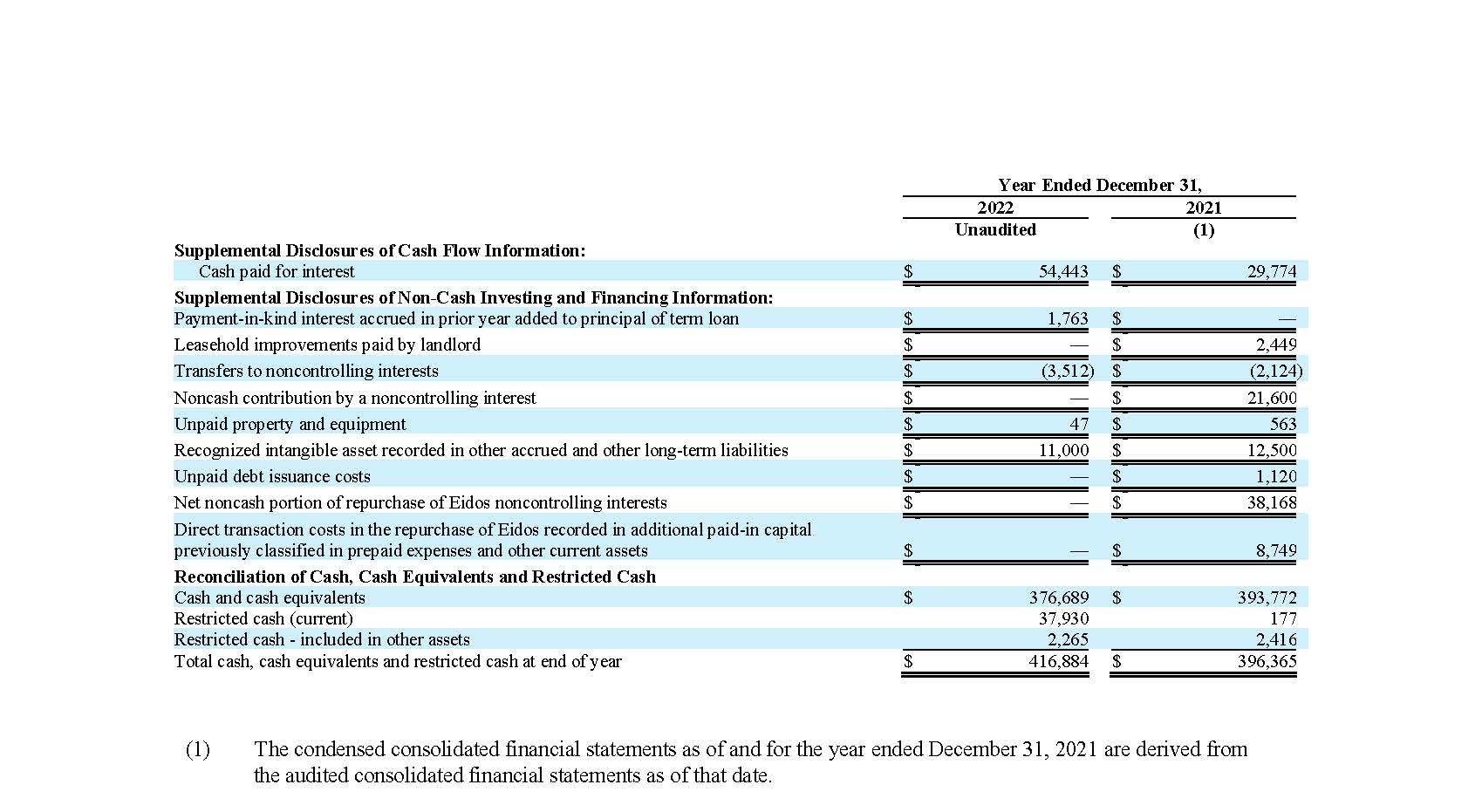

Cash, Cash Equivalents, Marketable Securities and Restricted

Cash (Current)

Cash, cash equivalents, marketable securities and restricted cash (current), totaled $466.2 million as of December 31, 2022, compared to $787.7 million as of December 31, 2021. The net decrease of $321.5 million in cash, cash equivalents, marketable securities and restricted cash (current) is primarily attributable to net cash used in operating activities of $419.5 million. Net cash used in operating activities during the fiscal year 2022 was partially offset by a $90.0 million upfront payment received under the License, Development and Commercialization Agreement by and among the Company, its affiliate, Navire Pharma, Inc., and Bristol-Myers Squibb Company, or BMS (the “Navire-BMS License Agreement”).

During fiscal year 2022, the Company also received $110.0 million from the sale of its priority review voucher, $10.0 million upon closing of an asset purchase agreement between its affiliate, Origin Biosciences, Inc., and Sentynl Therapeutics, Inc. and $4.9 million of net proceeds from the sale of common stock through an “at-the-market” offering. The Company made a $20.5 million mandatory prepayment of a portion of its term loan obligations under its Loan and Security Agreement, as amended, in connection with the upfront payment received from BMS.

As of December 31, 2022, the Company’s restricted cash (current) balance of $37.9 million primarily represents funds in a controlled account that was established in connection with the Second Amendment of the Company’s Amended Loan and Security Agreement. The use of such non-interest-bearing cash is restricted per the terms of the underlying amended loan agreement and is to be used solely for certain research and development expenses directly attributable to the performance of obligations associated with the Navire-BMS License Agreement.

Cash, cash equivalents, marketable securities and restricted cash (current), decreased by $92.3 million when compared to the balance as of September 30, 2022 of $558.5 million. Net cash used in operating activities was $93.2 million for the three months ended December 31, 2022 which primarily contributed to the decline in the cash, cash equivalents, marketable securities and restricted cash (current) during the fourth quarter of fiscal year 2022.

Operating Costs and Expenses

Operating costs and expenses for the three months and year ended

December 31, 2022 were $131.1 million and $589.9 million,

respectively, as compared to $178.5 million and $646.3 million

for the same periods in the prior year. The overall decrease in

operating costs and expenses for the three months and year ended

December 31, 2022 compared to the comparative periods was mainly

due to overall decreases in research, development and other

(R&D) expenses and selling, general and administrative

expenses resulting from the Company’s reprioritization of

its R&D programs and company-wide streamlining of costs. The

effects of the Company’s restructuring initiative that

began in the first quarter of fiscal year 2022 are now being

realized due to reductions of operating costs and expenses.

Restructuring, impairment and related charges for the three

months and year ended December 31, 2022 of $7.7 million and

$43.8 million, respectively, were primarily comprised of winding

down costs, exit and other related costs, impairments and

write-offs of long-lived assets, and severance and

employee-related costs. The Company continues to evaluate its

restructuring alternatives to drive operational changes in

business processes, efficiencies, and cost savings.

“We head into 2023 with cash on hand providing us with runway into 2024, and as we read out our key upcoming catalysts we expect to continue to allocate our capital carefully in order to preserve that runway and our optionality,” said Brian Stephenson, Ph.D., CFA, Chief Financial Officer of BridgeBio. “We will also continue to look for ways to extend our runway by considering potential royalty monetizations and partnerships.”

The Company’s research and development and other expenses have not been significantly impacted by the global COVID-19 pandemic for the periods presented. While BridgeBio experienced some delays in certain of its clinical enrollment and trial commencement activities, it continues to adapt with alternative site, telehealth and home visits, and at-home drug delivery, as well as mitigation strategies with its contract manufacturing organizations. The longer-term impact, if any, of COVID-19 on BridgeBio’s operating costs and expenses is currently unknown.

About BridgeBio Pharma, Inc.

BridgeBio Pharma, Inc. (BridgeBio) is a commercial-stage

biopharmaceutical company founded to discover, create, test and

deliver transformative medicines to treat patients who suffer

from genetic diseases and cancers with clear genetic drivers.

BridgeBio’s pipeline of development programs ranges from early

science to advanced clinical trials. BridgeBio was founded in

2015 and its team of experienced drug discoverers, developers

and innovators are committed to applying advances in genetic

medicine to help patients as quickly as possible. For more

information visit bridgebiodev.wpengine.com and follow us on LinkedIn and Twitter.

BridgeBio Pharma, Inc. Forward-Looking Statements

This press release contains forward-looking statements.

Statements in this press release may include statements that are

not historical facts and are considered forward-looking within

the meaning of Section 27A of the Securities Act of 1933, as

amended (the Securities Act), and Section 21E of the Securities

Exchange Act of 1934, as amended (the Exchange Act), which are

usually identified by the use of words such as “anticipates,”

“believes,” “estimates,” “expects,” “intends,” “may,” “plans,”

“projects,” “seeks,” “should,” “will,” and variations of such

words or similar expressions. We intend these forward-looking

statements to be covered by the safe harbor provisions for

forward-looking statements contained in Section 27A of the

Securities Act and Section 21E of the Exchange Act. These

forward-looking statements, including statements relating to the

clinical and therapeutic potential of our programs and product

candidates, including the timing and success of our RAS program,

including preclinical data for our next-generation KRASG12C

GTP/GDP dual inhibitor development candidate, BBO-8520 and plans

to be in the clinic in mid-2023, updated data from our Phase 2

study of BBP-418 for patients LGMD2I, the timing and success of

regulatory discussions regarding potential paths to approval for

BBP-418, the ability of BBP-418 to be the first approved therapy

for patients with LGMD2I, the timing and success of a Phase 3

trial of BBP-418 in patients with LGMD2I intended to be

initiated in the first half of 2023, the availability and

success of data from our ongoing Phase 1/2 trial of SHP2

inhibitor BBP-398 in combination with Amgen’s Lumakras

(sotorasib), the availability and success of additional data

from our ongoing Phase 1/2 trial of BBP-812 for the treatment of

Canavan disease, the availability and success of additional data

from our ongoing Phase 1 study of BBP-671 for PKAN and organic

acidemias, the approval of NULIBRY (fosdenopterin) for treatment

of MoCD Type A in Israel and the EU, the availability and

success of initial data from our ongoing Phase 2 study of

low-dose infigratinib for achondroplasia, including plans to

deliver an update on Cohort 5 in the first half of 2023,

followed by the initiation of a pivotal Phase 3 trial, the

evaluation of the development of infigratinib in other

FGFR-driven skeletal dysplasias, the availability and success of

additional data from our ongoing Phase 2b study of encaleret for

ADH1, the timing and success of additional trials of encaleret

for ADH1, including the timing and announced design of a Phase 3

pivotal study of encaleret for ADH1, the timing and success of

our planned Phase 3 pivotal study of encaleret in patients with

ADH1, the availability and success of topline results from the

Part B Month 30 endpoint of our Phase 3 ATTRibute-CM trial of

acoramidis, expected in mid-2023, the availability and success

of data from our ongoing Phase 1/2 study of BBP-631 for CAH,

with an update anticipated in late 2023 or early 2023, the

timing, availability and success of an initial data readout from

our Phase 1 trial of BBP-671 in patients with PA and MMA

expected in mid-2023, the timing and success of discussions with

regulators and the expected launch of a pivotal Phase 2/3 study

of BBP-671 in PKAN in 2024, the potential of BBP-671 to be a

best-in-class therapy for PA, MMA, and PKAN patients, as well as

the first approved oral therapy for the treatment of systemic

complications caused by CoA deficiencies, if successful, the

success of our license agreement with Bristol Myers Squibb to

develop and commercialize BBP-398, including our eligibility for

development, regulatory and sales milestone payments and tiered

royalties, the success of our asset purchase agreement with

Sentynl Therapeutics, including our ability to achieve future

milestone and royalty payments from Sentynl Therapeutics and the

timing of these events, the timing and success of partnering and

out-licensing discussions for certain programs in our pipeline,

the timing and availability of delayed debt draws under our

senior secured credit facility, the success of our reduction in

operating expenses and our expectations for our operating

expenses and cash burn for the second quarter, the success of

our restructuring initiative and its savings being realized, as

well as our anticipated cash runway, reflect our current views

about our plans, intentions, expectations and strategies, which

are based on the information currently available to us and on

assumptions we have made. Although we believe that our plans,

intentions, expectations and strategies as reflected in or

suggested by those forward-looking statements are reasonable, we

can give no assurance that the plans, intentions, expectations

or strategies will be attained or achieved. Furthermore, actual

results may differ materially from those described in the

forward-looking statements and will be affected by a number of

risks, uncertainties and assumptions, including, but not limited

to, initial and ongoing data from our preclinical studies and

clinical trials not being indicative of final data, the

potential size of the target patient populations our product

candidates are designed to treat not being as large as

anticipated, the design and success of ongoing and planned

clinical trials, future regulatory filings, approvals and/or

sales, despite having ongoing and future interactions with the

FDA or other regulatory agencies to discuss potential paths to

registration for our product candidates, the FDA or such other

regulatory agencies not agreeing with our regulatory approval

strategies, components of our filings, such as clinical trial

designs, conduct and methodologies, or the sufficiency of data

submitted, the continuing success of our collaborations, the

Company’s ability to unlock additional funding under our credit

facility, potential volatility in our share price, potential

adverse impacts due to the global COVID-19 pandemic such as

delays in regulatory review, manufacturing and supply chain

interruptions, adverse effects on healthcare systems and

disruption of the global economy, the impacts of current

macroeconomic and geopolitical events, including changing

conditions from the COVID-19 pandemic, hostilities in Ukraine,

increasing rates of inflation and rising interest rates, on

business operations and expectations, as well as those risks set

forth in the Risk Factors section of our Annual Report on Form

10-K for the year ended December 31, 2021 and our other filings

with the U.S. Securities and Exchange Commission. Moreover, we

operate in a very competitive and rapidly changing environment

in which new risks emerge from time to time. These

forward-looking statements are based upon the current

expectations and beliefs of our management as of the date of

this press release, and are subject to certain risks and

uncertainties that could cause actual results to differ

materially from those described in the forward-looking

statements. Except as required by applicable law, we assume no

obligation to update publicly any forward-looking statements,

whether as a result of new information, future events or

otherwise.

BridgeBio Contact:

Vikram Bali

[email protected]

(650)-789-8220